Whether a Client needs advice in my capacity as a Coordinator or simply as a friend, I’m honest to such an extent that it’s not uncommon for me to use my own life as an example in order to keep someone else from making the same mistakes that I have by trusting someone.

Many of my Clients have asked me my opinion on Prenups. In certain situations, this document can prevent someone who has far more than their spouse from losing half of their assets in a divorce.

A lot of folks are offended if you ask them to sign a Prenup. They shouldn’t be. If one of you has far more than the other, a Prenup is actually a pretty important “discussion.”

Today, we are going to dive in to Sexually Transmitted Debt. Haven’t heard of it? Well, if you are marrying someone, you need to educate yourself because love is the #1 reason for this to occur to an innocent bystander who marries someone saddled with debt and doesn’t realize it PRIOR to marriage.

Sexually transmitted debt is where one person in a relationship becomes responsible for their partner’s financial debt usually after being either unaware the debt existed prior to marriage or being convinced or misled into taking on debt in their own name upon marrying.

Insisting on a Prenup or at the very least, a credit report is often necessary to effectively protect yourself from your future spouses Tax Lien or Debt Lawsuit when you thought your new spouse had their act together but, secrets you weren’t aware of come to light years after you married. It’s best to know the situation UP FRONT.

In my lifetime, I’ve encountered BOTH situations with my previous and current husbands. No, I didn’t insist on a Prenup because I had no idea a problem existed.

Which is why I’m adamant that Clients consider the good, the bad and in many cases, the ugly side that marrying someone will literally piggyback THEIR EXISTING DEBT onto the back of the unsuspecting spouse. I’ve been that spouse myself.

If you marry someone with debt, their debt NOW becomes community debt. If you divorce, you now get 1/2 the debt of your partner. If your partner dies, you still get the bonus of being saddled with their debt.

Debt Infection through matrimony is the No. 1 way to transmit debt across the generations: 24% of baby boomers, 26% of Gen Xers and 31% of Gen Y say they took on a partner’s or ex-partner’s IOUs after saying “I do.”

Then there’s the other side of marriage: divorce. Debt divvied up in divorce settlements affected 23% of boomers, 15% of Gen Xers and 8% of Gen Y.

Years ago, I was already going through a marriage that was ripe with other issues including infidelity. This affair was what actually drove me to marriage counseling.

You see, in order to deal with my consistent disappointment regarding an ongoing four year affair my husband was having at the time, was disruptive enough to my life already when the second shoe fell.

What was it? A shocking letter from Tarrant County regarding a Tax Lien in MY NAME. This gave me a very real wake up call. Good Lord.

I couldn’t believe it then and even today cannot believe it actually happened to me but, it did and, I had to fight the tax lien. “Just sign here. We are married now and filing jointly is part of being married.” Yep. Just signing there signed ME right up for a joint tax lien.

Opening a letter from the courthouse regarding a $78k tax lien was the LAST THING I needed in a marriage that had issues of infidelity 14 years ago. I was instantly gut punched and devastated. At the time, I actually believed my credit AND future had been completely ruined.

I had been rope a doped. Pulling myself off the sideline and the ground would take patience, education and a full understanding of Tax Law. Particularly Innocent Spouse.

Saddled with a joint tax lien that would take me forever to pay and my credit ruined? I was nearly on the edge of a Psychotic Break that day. After all, I had one year prior settled a child custody battle.

Quite frankly, love letters to my husband from his mistress also “graced” my mailbox all those years ago. I had a LOT of negatives going on during that marriage with the only positive being my son, my family and of course, my work.

Because of that lien letter, I no longer file joint tax returns not because I don’t trust my current husband but because I’ve been sucker punched before and, it changed my life. Once bitten twice shy.

During my second marriage, just checking the mail was similar to expecting a bomb to go off in my hand emotionally. My mailbox became the Devil to me due to Laurie sending cards to my former husband throughout our marriage.

Checking the mail became one anxiety attack after the next for the first four years out of the six years of my marriage spent with my ex “for better or for worse.”

The tax lien in the mail though was a literal Dealbreaker. I was already trying to find some resolution via Counseling for dealing with my trust issues regarding the affair and the tax lien destroyed any hope of salvaging my marriage.

You may be wondering where this blog is headed so, saddle up and get ready for a Helluva Ride.

How did my past experience with tax liens and Debt Lawsuits come up after all of these years? I closed that door years and years ago.

Here’s what happened to open Pandoras Box:

One of my Brides who had actually hired me months ago for a Coordinator and Officiant at her “big budget” October wedding in California called me today after she “accidentally” opened up a Debt Lawsuit Default Judgment addressed to her fiancée.

No one who is going through life happy and excited planning their wedding actually expects a Debt Lawsuit OR Tax Liens but, MAYBE they should.

What about unpaid child support or school loans? A credit report answers those questions for you.

You NEED to know who you are marrying. Their debt can quickly become YOUR DEBT TOO.

In my opinion and personal experience, previous Default Judgments, Debt Lawsuits, Unpaid Child Support or School Loans are PRETTY HEAVY LUGGAGE.

Prenups and Credit Reports not only protect my Clients but, in many cases often enlighten them.

Although my Bride was effectively sucker punched, she had spent some time absorbing the shock. An accident of opening this letter or curiosity regarding why a letter from the courthouse regarding a Lien was addressed to her fiancé?

Alarmed, she had called me from Dana Point, California to discuss getting cold feet. Who could blame her?

We are now effectively “in the countdown” on this wedding and “surprises” prior to the Wedding Rehearsal October 15th would give any Bride second thoughts.

“What else could he be hiding?” It’s a legitimate question. Also, a question that I couldn’t answer that accredit report could.

“In the forest of life, remember that the handle of the axe that cuts you down was once a tree.” My sisters saucy Quote fit this situation to a tee.

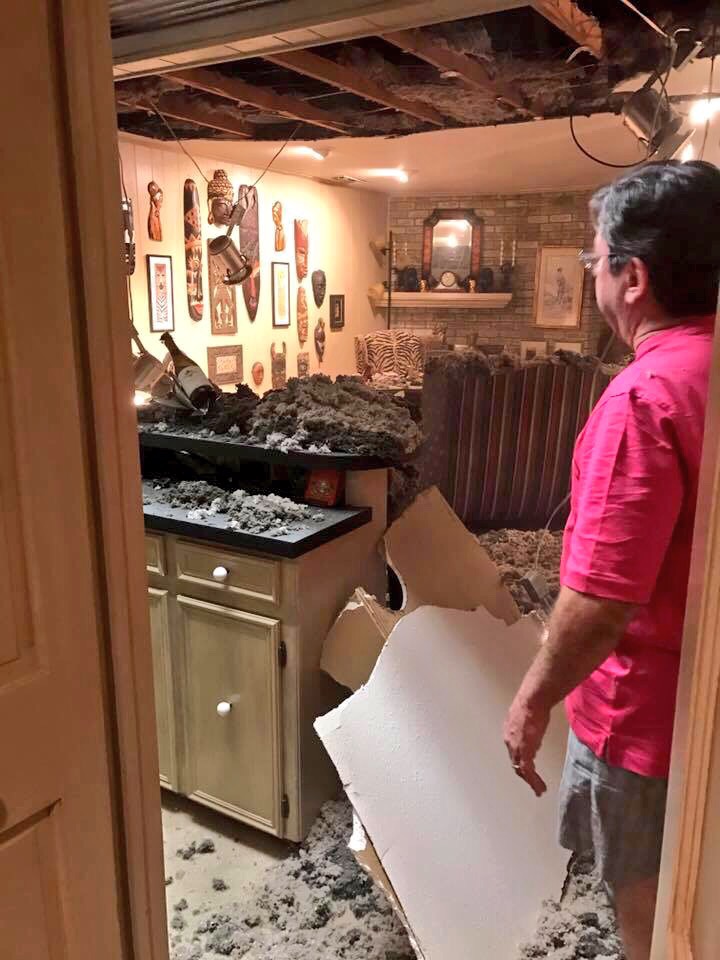

I was actually covered in insulation and busy vacuuming the furniture I had been forced to leave “as is” for insurance purposes when the “California call” came in.

For the past nearly two weeks, my ceiling caving in due to North Texas rain has occupied my life while bouncing from client meetings to events and meeting contractors.

We are nearly finished with repairs to the structure and I was actually only waiting on the furniture to be cleaned.

The State Farm adjuster had just left after taking photos which finally gave me an opportunity to start vacuuming insulation from every piece of furniture that had been in the room at the time of the crash.

Since everyone asks for the “before and after photos” of something I never expected to happen, here they are.

Going through the motions to put my home back together again before leaving for Destination Events in California has been stressful but, I’m hanging in there.

This unexpected disaster damaged my furniture and upset my life but, I’m blessed that I wasn’t in the room at my desk and neither was my dog, Foxy Wortham or one of my three grandnieces.

This unexpected disaster damaged my furniture and upset my life but, I’m blessed that I wasn’t in the room at my desk and neither was my dog, Foxy Wortham or one of my three grandnieces.

This “disaster” could’ve been much worse if someone had been standing under the attic that caved in. Having sheet draped furniture covered in insulation stacked up in my other rooms reminded me just how much furniture I had in ONE ROOM.

Having sheet draped furniture covered in insulation stacked up in my other rooms reminded me just how much furniture I had in ONE ROOM.

I remember thinking to myself “I might be a hoarder?” The thought had actually never occurred to me before.

I really had no idea how much stuff I had in my built in cabinets and shelves until I started the lengthy process of dusting everything off.

Preparing to take the call, I had set aside my inexpensive but, highly effective Shark Vacuum (no, I’m not branding but, if your attic ever caves in you need this vacuum) aside, I literally fell sideways and half exhausted into a Texas Twins Treasures cuddle chair with sweat furrowing across my brow and a little breathless to answer the call from my Dana Point Bride.

Whenever I get a call from someone crying, I’m instantly hyper aware that there’s a problem. Listening carefully to the facts is essential to finding a solution. I actually thought this call would be to cancel the upcoming wedding with a hysterical Bride on the other line. Heavy sigh.

My Bride: “I hate to bother you but, I need to talk to someone unbiased and my mother isn’t the one I choose to tell. I trust you. You’re actually like my mother only in a non judgmental way. Do you have a few minutes?” Me: “Sure, I’m just vacuuming before the cleaners show up to dry clean the furniture. Is everything okay?”

My Bride: “I saw a courthouse letter and thought maybe it’s about his child custody case and since I’m helping him pay attorney fees, I opened it.” Me: “What was it about?”

As I ask this, my heart is heavy knowing whatever it was, it’s upsetting to such an extent that my Bride actually had to sit back and think who would keep this information secret. Not surprisingly, she chose me.

My Bride: “Well, it’s a judgment. There are names on the upper corner that I don’t know and his name is under theirs. This looks official and it’s a LOT of money. Since he lives with me and I don’t think he has this sort of cash available, I’m really scared. Can they put a lien on my house?”

Hmm, this is a biggie ya all and once you marry, it’s a biggie that’s going to impact your marriage and not in a “good way.”

Since it’s the second marriage for the Groom who also has a child, the Bride who hasn’t been married but, has more money is now concerned about her personal property.

It should be noted that I carefully but strongly suggested a Prenup to my Bride months ago.

This “Prenup Suggestion” had upset the Groom at the time. However, the Groom didn’t hire me, the Bride DID. My allegiance is to MY CLIENTS. My role is to enlighten and educate my Client.

Thank God that my Bride was as concerned as I was about protecting her assets to insist on a Prenup at my suggestion. As a parent myself, it’s fairly easy to watch your child “blinded by love.”

But, as a businesswoman, protecting my Client regarding contracts for other vendors as well as a contract to protect them in certain situations isn’t as unusual as you might think. Somebody has to look out for these folks and quite often, I’m the someone.

I decided to go make myself an ice coffee and wait for her to absorb the tax lien aspect of this scenario. This was going to take a few minutes and, I was going to need caffeine to have the energy.

Trying not to sound as alarmed as I actually was remembering where I had been and hoping to never again revisit my past experiences with Tax Liens and Debt Lawsuits, I sipped my iced coffee before responding.

The truth was only going to further disillusion my beautiful Bride. At the moment, she was still wondering if the lien was real and how it came to be. I already knew the lien was real coming from the county courthouse and also had no doubt that the Groom wasn’t unaware of this trouble that he had most likely, hoped to beat before “wedding hour.”

Me: “If he’s been sued once, he will be sued again. Debt buyers actually buy time barred debt specifically to sue the respondent. If he now has a judgment, he’s on a Hot Sheet. Meaning, other Debt buyers are going to follow suit and file on him. Here’s how it actually works. He stops paying his car, his phone, his credit card. The company (original lender) writes off the debt aka a charge off. Over time, Debt buyers come along and pull his credit to search for charge offs and then add a “new account” on his credit report. This new account isn’t actually a charge account. It’s a debt account. Re aging old debt or Zombie Debt is a REGULAR OCCURRENCE to such an extent in the US that JP Courts have upped the cap in Texas and many other states. I’m well aware of Debt Lawsuits and also IRS Liens for “forgiven debt.” What this means is that if someone stops paying an account, they benefitted from the revenue that they would’ve spent to their creditor. I think you need to speak to him in person and request a copy of his credit report. He knows there’s a problem. My guess is that there have been numerous letters and phone calls long before this suit was ever filed. He’s ALSO chosen not to tell you any of this which is a problem.”

It’s well known that I HATE SURPRISES. As a planner, I try to have a Plan A, Plan B and Plan C but, this wasn’t going the way my perfect California trip was planned at all.

This Bride is so sweet and well mannered that I hated that she was devastated. I was so sick about it myself that I waited for her to stop crying to respond. Heartbreak hurts. I’ve been there.

EVEN if someone is successful at fighting and winning a Debt Lawsuit, Debt buyers often use their second “fallback option” AND report the income (unpaid debt) to the IRS.

I instructed my Bride to tell the Groom to FREEZE his credit immediately before one lawsuit turns into 10, 20, 30 or more from other third parties.

It’s surprising how many folks have never heard of Freezing their credit. You wouldn’t leave the house without zipping your pants would you? Why leave your credit accessible to anyone?

Let’s examine Hot Sheets. What are they? Lawsuits and Default Judgments are actually HOW Debt Attorneys find their victims they open a window of other Debt attorneys filing lawsuits. By coming across the name of a litigant (or victim), Collection Attorneys have a name.

Most lawsuits also have a Social Security number when they involve debt. Using this information, the Collection Attorney pulls the credit report and, the game of “gotcha” literally begins. Why? Most people who Default do it across the board. There isn’t only one or two derogatory accounts. It’s a flood and if you don’t want to drown, you need to Freeze Your Credit.

Freezing your credit prevents other Debt Buyers from pulling it and filing future lawsuits on the Defaults.

It’s a highly lucrative business whether you realize it or not. Debt buyers profit from their merciless search for Zombie Debts.

If you get sued over Debt just once, buckle up cause the Tornado just got started. Years ago, this was uncommon but, things changed about 15 years ago.

There isn’t ANY limit on the number of times you can be sued on the same debt. Think about that. You just got sued on one item and somewhere in another county, usually nearby, someone else is filing the same suit on the same Debt. Ninety nine percent of the time, these lawsuits are filed “Non Served.” The Plaintiff also often seeks a Default Judgment.

Re Aging Time Barred Debts is so common these days that while you are busy absorbing the first lawsuit, the shock of finding yourself sued again on a debt 10, 20 or even 30 years later confuses and baffles you.

How does this happen? The Debt Buyer initiated a “new account” after pulling your credit report. Experian, Transunion and Equifax LET THEM.

This “new debt account” will also effectively Re Age a time barred debt that was once previously protected by a time bar statute against a lawsuit.

If you are one of the people who Defaulted years ago, open your eyes. I can promise you that a Collection Attorney somewhere is looking to find that old debt. Pull your credit immediately and then, Freeze It at Experian, Transunion and Equifax.

You will need your old credit reports to prove the date of the default. Otherwise, you have no credible defense to a time barred Debt Lawsuit.

Nonserved litigants also “discover” Default Judgments years later they never realized because they were never served a citation regarding the lawsuit.

I learned everything there was to know about Debt Lawsuits in order to better understand them and more importantly, fight them. Not for me but, for my husband.

Due to an unexpected “debt lawsuit crisis” years ago for my current husband, the shocking statistics regarding Debt Lawsuits were quite alarming to me. I attended hearings that were virtual “cattle calls.”

All of these people herded into a room with a sassy collector holding a repayment document that confused consumers signed thinking they would go to jail if they didn’t.

No one had an attorney and no one really knew what was going on. Mind you, these were the folks “lucky enough” to have been notified of a lawsuit. Think about all of the others who weren’t.

Since I spent years in courtrooms and read everything there was to know about Debt Lawsuits and Default Judgments, it didn’t take me long to realize how horrifying this trend actually was.

I was determined to understand the process and find the loopholes. Why? I had to in order to defend my husband.

My current husband was unemployed for 3 years during the real estate crisis. He went from $300k and up as a builder and developer a year to ZERO.

Sure, we had savings but, we were also forced to pay his credit cards with the savings. He had hoped to find work and replace the savings or at the very least cover our debts but, real estate took years to recover. Because of this, we lost all of our savings by paying his credit cards until we no longer could. His were far higher than mine. I rarely used my cards and when I did, paid them off as I still do today.

My credit cards are now used only to rent cars and hotel rooms for travel but, they aren’t used for shopping or dining out. They never have been.

It took me years to get a good credit card after my first divorce and no one was more thrilled or honored than I was to have REAL CREDIT.

When you don’t have money, you learn to Barter. I did. People ask why we have The Pawning Planners and a Barter Option? Experience. You lose customers who have no money but may very well have assets.

Where did I get that experience? Talking the car salesman into accepting a mink cost for the GEO Storm I bought after my first divorce. I had no credit at all and, very little money. I can sell anything. I’ve had to over and over again.

If you know the value and know the market, you probably can to. Just don’t look desperate. It will kill your sale. I always looked like I could care less whether you bought today or next year. It was Christmas Eve and the perfect time to swap a coat for a car so, I did. I actually drove the GEO for three years without an air conditioner. I learned to check for an actual air conditioner on my upgrade vehicle though.

Selling that mink by convincing the sales manager of the quality of my coat he had been admiring on a cold North Texas night didn’t take too much convincing.

Me: “your wife would love this, it’s a gorgeous mink that any gal would love. Have you already bought her something special? I really don’t have enough money to cover the down payment but, I will take this mink coat right off my back and trade it for the down payment.”

Salesman: “Are these coats expensive? My wife has always wanted one.” Deal sealed.

I rolled right off the lot driving a car with no air conditioning (although it had a button) and was on my way to establishing MY OWN CREDIT via the car payments.

A year later? My first credit card. I was in awe of that card. Shiny and gold with my name on it. A miraculous addition to my wallet. I had finally made it on my own and had credit. I cried.

That’s how hard I fought to get my own credit. How much I sacrificed. No one GAVE me credit. I earned it. I wasn’t going to let anyone take it away from me. Husband or not.

My third marriage would put me in a slippery slope of having to choose to live off my credit cards or sell everything I owned.

Our first year was perfect. Plenty of money and no worries. But…things would change and quickly for us. The real estate crash was felt for years in our home. The only industry my husband had ever known.

When the real estate crash finally wiped us completely out, we couldn’t afford to hire attorneys. We were trying to save our home. By the time I realized that were spending all of our savings trying to pay Matthews credit cards for 2 years before we ran out of savings, I quickly realized that I couldn’t afford to pay his credit cards and mine.

The end result? Debt lawsuits against him. I wasn’t giving up my cards. I couldn’t. I fought to hard to have them.

By the third year of my third husband being unemployed, I began selling everything we owned. From my furs, to jewelry to even our cars, the only asset we saved was our home.

I went from driving an Escalade and a Crossfire to a Hyundai. I was okay with the step down to be honest with you. The gas bill was killing me. I didn’t need to impress anyone. Sure, friends were unimpressed but, they weren’t paying my bills.

During my third marriage, I had lost everything I owned but, had I not chose to fight, lawsuits against my husband would have entirely become default judgments and would have eventually wiped out any future earnings we would have ever made. Debt attorneys know this which is why they want Default Judgments. They are patient.

My husband was literally forced to default on all of his credit cards because we had run out of money to pay them AND subsequently, my husband was sued 17 times.

Even today, he will not carry a credit card. He will never get over where he’s been. My husband is a cash only customer.

I defended my third husband successfully on EVERY lawsuit except one.

The war lasted 4 years. It was an awful way to start our life together. By the fourth year of fighting debt lawsuits, I was earning enough money to hire an attorney and did. Why? I was tired and mentally exhausted. I hired Jerry Jarzonbeck to finish the last one.

It was a horrible time for both of us as we had only been married a year when real estate crashed. What a honeymoon!

I had to fight because my husband was in no condition to represent himself. I’m not kidding. He was suicidal. The lawsuits forever changed him.

After I successfully forced non suits on the first two of his lawsuits, he finally believed that I could pull us out of the Hell our lives had become.

Getting sued at his age was horrifying and embarrassing. All of the lawsuits were third party Debt buyers.

I fought for my husband and learned how anyone like him who had lost their job, got sick or was going through hard times had also been sued.

After dealing with tax liens all those years before, I was now more than a little familiar with the legal process. Yep, back to the Law books again on my third marriage.

I know more about Debt lawsuits than others because I had to learn how to fight them and, I did. I fought harder than anyone would for my husband and, I saved him.

When you are forced to make this type of a choice- you need to educate yourself and do whatever you can to survive. I did.

Filing an answer to a lawsuit is imperative. Failure to do so will result in a Default Judgment.

Fighting my husband’s lawsuits was one of the hardest thing I’ve ever done in my life but, I learned a lifetime of Debt lawsuit information in a short window.

I learned how to file answers. I learned how to file Interrogatories. I learned how to send Certified Copies of filings and I learned not to give up.

What people don’t know about Debt and Lawsuits, IRS Liens or their partners credit can and will hurt them.

Third party Debt Lawsuits are shocking and often have little or no documentation because Debt buyers have 1 or 2 documents without the entire file.

The majority of these Debt lawsuits are on Time Barred Debt– Federal Trade Commission- Time Barred Debt.

Millions and Millions of people never knew they had been sued. Why? Sewer Service. Debt Lawsuits are like a cancer to anyone unaware that they exist.

If you have charged off debt, Freeze your credit FIRST then call the Courthouse or go online and search your name.

You will also need to keep checking the courthouse. Why? Because you need to know if you’ve been sued and file an Answer. If you don’t, you only have a limited window to fight a Default.

The majority of Debt Lawsuits and subsequent Judgments ARE ON NON SERVED LITIGANTS.

I advised my Bride to go online and check the Groom for other lawsuits or judgments. It’s easy enough to do.

I’m guessing that tomorrow she will most likely VISIT the courthouse if the Groom chooses the “evasive” route. I would too.

Telling a surprised client that “it ain’t over” isn’t easy. It’s difficult. I’m old enough to be wise.

Due to my life, I’ve learned very important things the hard way because I’ve had to. Education is priceless.

Reading law books during my previous marriage regarding taxes, if you had told me “I’d be hitting the books again” with my third husband, I would never have believed it but, it happened.

No one wants to have their property encumbered but, what about your credit? How does your partners credit affect your own? You cannot discharge a tax lien even in bankruptcy.

Well, if you get joint credit cards or a home, it will. Read on to find out why I know so much about infidelity, Tax Liens and Debt Lawsuits.

Years ago, I WAS THAT BRIDE myself! My previous husband worked as a Tax Consultant for Ad Valorem Taxes.

He also regularly “negotiated” tax liens. I had no idea of any of this but, ignorance doesn’t keep bad things from happening to you.

My ex had a lot of secrets. Tax Liens and a mistress? Check. An affair referred to me as an “overlap” two years prior to the tax lien? Yes. Four years of an affair destroy your self esteem. You wonder what’s wrong with YOU? I did.

I already knew my previous marriage was going to Hell in a Hand Basket two years before the tax lien. Four years of “Laurie” had made me a zombie.

Sure, I could still smile for my photo shoots and modeling gigs or commercial work. After all, I was a trained model. A hangar with a smile and charisma. When I was working, I was ON. When I was home, I was off.

Laurie had haunted my marriage like a ghost. The whispered phone calls late at night. The love letters with hearts drawn on the envelope. All of it.

Heck, I was even in marriage counseling attempting to deal with my anger while coming home to yet another “love letter from Laurie” in my mailbox.

But, addressing the Laurie situation would wait for years. Why? Well when I married my second husband, I had a car. Not a luxury car but a new one. It took me years of driving a pos without a/c to afford that car and I was proud of it.

The first time I left Guy over Laurie was after he had me sign over my new car to his nephew immediately after marrying him years earlier in order “to get me a nicer car,” I would learn that I didn’t own my car when my ex sent someone to pick up HIS car from me.

In order to fix that situation, I left Texas Patios and took a job at Frank Kent Cadillac to effectively, get a FREE DEMO. I had learned that not having a car was a real hardship.

I needed to make as much money as I possibly could to plan my escape from a marriage that was killing me.

After my first divorce, I learned not to fly off to the courthouse and let the chips fall where they might. Before filing for my second divorce in 20 years, I needed a plan, money and a car.

It was one thing after the next in my second marriage. He wasn’t hitting me but, he was hitting me just the same. Mental abuse is just as real as physical abuse. I spent years arguing about Laurie with my second husband. Years.

But, running off in a huff to file a divorce would cut my own throat. Instead, I went to marriage counseling and tried to forgive a husband that would consistently break my trust.

While doing so, I was making an escape route for myself and my son far away from the country clubs, vacation homes and sorrow my life has become.

A month before the tax lien arrived, a circular for Fort Worth City Club arrived in my mailbox. I was at our Lake Home with my sister and son when this photo was taken and YET, under the photo of MY husband with Laurie read the caption “Guy and Wendy McCollum enjoying a candle lit dinner at City Club.” Be me. Be me with my twin sister asking “who is that? Isn’t that YOUR dress?”

I was already in marriage counseling and my ex is running around town with someone who doesn’t even look like me and posing for photos? I could not believe it.

I had already strongly suggested to stop parading Laurie around Fort Worth. Why? Getting stopped at Ridglea Country Club by employees to ask about “his sister” had already alerted me to the fact that Laurie had created a new identity as his sister.

I had continually insisted that Guy stop embarrassing me in Fort Worth or Arkansas long before the City Club circular came in the mail.

I decided to immediately rent a townhouse for myself and my son that I could easily afford with my job at Cadillac because obviously marriage counseling wasn’t making a dent in my trust issues and someone wasn’t bothering to do anything to re establish it either.

If your husband or wife is unfaithful, he or she isn’t going to change. Trust me, I’ve been there and I’ve done that.

Confrontation is difficult but, it’s especially difficult when you have days to study the photo in a circular of your “happy husband” smiling at the camera wearing the Anniversary watch YOU bought him.

Yes, I looked at every detail and noticed Laurie was wearing one of my necklaces with matching earrings. I wondered what else she had borrowed and, if she was the same shoe size too?

I was SO LIT about that photo of Guy and Laurie you will never know. Since he was out of town on “business,” I called him to demand why on earth we were bothering with marriage counseling when every time I left town, he was meeting Laurie in Fort Worth while I was at the Lake House OR meeting her in another city and hotel.

Laurie was a literal blanket over my marriage. She was suffocating me and I was for years, helpless to change the dynamics.

I had to prepare. I had to be able to support myself and my son. Private school, housing and other factors drove my decision to plan and execute leaving.

My ex husband: “It’s just an overlap. I don’t know why you are so upset about this. You are a workaholic and often busy with your sister and her family. I told you both not to adopt the twins and yet, you and Cindy did so anyway. I have issues because you don’t listen to me and Laurie helps my self esteem.” Laurie was destroying my self esteem.

My ex husband had nothing to do with adopting the twins either. I helped my sister hire an attorney and was listed as a secondary guardian. Throwing the twins into that argument was not only arrogant of him but also, intentional to change the subject.

I was so sick of dealing another Laurie argument that I decided to use one of those love letters with a return address and hired a PI to find out more about “old Laurie” smiling back at me in that photo.

I was going to find out whatever I could regarding this home wrecker AKA Laurie and use the information to “out” her to her husband if in fact, she was married. I was right. Laurie was married. Humph.

I knew that Guy wouldn’t support her financially and wholly because he was quite stingy with his money. My ex had a habit for going after married women.

After all, I paid my own bills and insurance and even bought my own groceries. My ex wasn’t freewheeling with his money enough to support a love nest for Laurie.

Years of Laurie haunting my marriage had turned me from a victim constantly feeling sorry for myself when I wasn’t crying about my inability to get rid of Laurie. Instead, I was turning into a a fighter for victory.

A week after hiring the PI, Laurie’s husband was looking at the same photo from the privacy of his office. I didn’t send that certified package to Laurie’s home because I knew she would most likely, intercept it.

Those love letters sent to my home were in the same envelope. I felt like her husband needed to read them himself and since my ex saved them in one of his drawers, I included the photo from City Club and the love letters in the same envelope.

On the one hand, I felt sorry for Laurie’s husband but, on the other hand, he needed to know what was going on. He was as much a victim of this affair as I was.

I don’t believe in infidelity. If you can’t be honorable to the person you married, get a divorce.

The phone calls from Laurie and her ridiculous love letters finally stopped after my investigation to find out more about her. After all, she knew quite a bit about me from my dress size to my perfume to even my schedule!

After alerting her husband, Laurie finally left my ex alone. Old Laurie was now quite busy “sweeping her own porch at home.”

I finally got did get rid of the woman who consistently caused my ex to leave the room to “take this important call.”

My broken self esteem and trust would take another hit with that tax lien but, I was through feeling sorry for myself. I was worth fighting for and, I was preparing for a tax battle in order to defend myself.

If you are having an affair, it’s most likely that your spouse is aware something is going on. Get a divorce and spare your spouse. It’s the honorable thing to do.

By the time I had married my second husband, I was smart enough to never quit my job or give up my income. Throughout my life, the one thing I could count on was working. I’m serious. Work is my salvation.

During my second marriage, I actually even changed jobs in order to have a car and make more money.

Leaving a job that I had worked nearly ten years was based entirely on a commission cut that greatly affected my earnings. I literally couldn’t afford to stay.

Taking a job making three times the money with free gas and a free car was the smartest move that I have ever made. EVER. I’ve done a lot of smart things in my life but, Cadillac was the smoothest move careerwise that I’ve ever made.

Quickly, I went from struggling to pay my bills to taking my sister, son, nieces and grandnieces on fabulous vacations. Beautiful demos and free gas? Best move ever.

I didn’t trust anyone to support me and because of my fear, refused to stop working prior to my second marriage. By the time I married my second husband, I already had my own credit cards and checking account. I also had bought myself a Taurus wagon with air conditioning and was really proud of it.

This next part is really important and soon, you will find out why. Tax liens are based on income. I had no access to my ex husbands income during the six years of our marriage and, I could prove it.

I didn’t benefit from my ex husbands income because I had no access to it. What he didn’t know was about to hurt him regarding that tax lien. Seriously. A king counting his coins was about to lose his crown.

Checking the mail with my usual apprehensive hand, that letter from Tarrant County addressed to ME was the last nail in the coffin of my marriage.

I was already “feathering my nest” at my secret townhome because I had nothing left to give and because I’m a planner.

I couldn’t take it anymore with Laurie’s perfume wafting through my weekend home or my home in Fort Worth. She was everywhere.

Wondering if Laurie was wearing my clothes and sleeping in my bed, I didn’t feel guilty about preparing to leave my husband. In fact, I felt entitled.

I had left my first husband after being hospitalized one last time and didn’t prepare. The violence and the fear drove me to act without planning. I made a mistake then and would never make it again.

Not having money or credit when you are filing for a divorce is a real problem. I would learn from my mistakes.

Ironically, my first and second husbands both kept my cars. Because of this, I had to find a way to get a vehicle on my own.

I worked hard at establishing my credit after my first divorce and I refused to let that tax lien destroy my credit. Flat out refused. This was war.

My ex: “I’m going to pay that. Stop overreacting. I make enough money to cover it and I will take care of it.”

Sure, that’s why you had a history of tax liens in the first place. Probably if my ex hadn’t also had an affair throughout our marriage, I might have believed him but, years of lies had effectively “snapped me out of it”

By the time I decided to leave my second husband, you can bet your ass that I was overprepared. After all, I had a son to consider and I had gone from the once happy carefree mom leaving a volatile first marriage to the beaten down shell of my former self after pulling myself together from my first divorce. My second marriage was killing me. But, from the outside looking in, others envied my position. If they only knew!

That tax lien was an unforgivable “gift” that would take me years and years and years to satisfy. I simply could not be a doormat anymore. If saving myself from a marriage that took far too much from me upset my ex husbands friends and family, they didn’t have truthful or reliable facts regarding how “Wendy nearly destroyed Guy by putting a tax lien on him.” Guy nearly destroyed Wendy but, Wendy got back up. It wasn’t so much that I wanted to get even more than it was that I wanted to get my credit back.

The difference was that Wendy learned tax law and Wendy reversed the lien. After all, I wasn’t earning nearly enough per year to warrant a tax lien of nearly 80k. Let’s get real here.

Standing there holding a tax lien with Susie the housekeeper asking if I was okay that day years ago, I knew that something else besides old Laurie was going on that (most likely) had been going on for quite some time.

My ex had a lot of secrets.

His first wife also divorced him for being unfaithful. I wouldn’t know this until meeting her though during my divorce.

I actually met her at Cadillac. Like me, she was devastated by affairs. Like me, she found someone she could finally trust again.

Trust is like a drinking glass. When it’s broken, don’t expect it to hold water with anyone else.

The day I opened that tax lien, I drove my Cadillac like a lunatic to the Courthouse. I sat on the Courthouse steps crying my eyes out.

How would I buy a home? A car? Get a job? My credit was ruined. Credit I had carefully all for my entire life created. I couldn’t stand it. Wouldn’t stand it.

Wearily, as people passed me (most of them attorneys) wondering why that redhead didn’t go home and cry, I decided I was going to fight back AGAIN just like finding Laurie’s husband to get rid of her once and for all.

This time, I needed tax knowledge. I had a part time job at H&R Block by the end of the week.

That’s right. I was going to learn all about tax law and… get paid to do it! I went to libraries and stayed up late reading about tax law when I wasn’t moonlighting at H&R.

Wars aren’t won without preparation. You don’t just get lucky. You prepare. You plan and eventually, you execute your arsenal of knowledge to properly defend yourself.

Since my ex husband told me his usual “get over it” about this devastating tax lien, I was going to “give it back” instead.

Like tennis, the ball in my court would effectively be bounced back.

I filed for Innocent Spouse 3 weeks later from the comfort and security of my new townhome. It was beautiful and cozy and I loved it. No mail problems either.

Although I still checked for mail at my “other house,” my ex wasn’t aware of it. I found a letter from his tax attorney (that’s right he had plenty of money for attorneys).

Looking at that return address, I took the letter. After all, my name was on it too. Although I had already moved to the townhome, I didn’t feel guilty opening a letter from a tax attorney that had my name on it.

I faxed this letter to my caseworker at the IRS from Frank Kent Cadillac (my day job) after reading it.

The letter: “Guy, Wendy has never had an issue with the IRS. You’ve had 17 tax liens the past 20 years. It’s in your best interest to move this burden to her.” Well now, this WAS planned.

Now, back to separate checking accounts, credit cards and other “personal property,” it’s important because between that letter AND our separate completely separate money, I won that Innocent Spouse case and cleared my credit too. That’s right. True story. Thanks H&R Block you helped me more than you will ever realize. Really!

My money and car problems were solved FINALLY. Running my own Cadillac ads? Pure genius.

I had been a print and commercial model for years and knowing that my ex was looking at MY SMILE from Ridglea Country Club looking back was pure and sweet revenge. True story. The tax lien would be removed from my credit after finally winning the tax lien war. I was feeling great and it showed.

The tax lien would be removed from my credit after finally winning the tax lien war. I was feeling great and it showed.

No more tears for me ya all. I fought harder to protect my credit and my future than anyone ever had expected. I educated myself and I survived.

I also explained my “scenario” to my Bride just as I have to you dear readers. You can overcome someone breaking your trust. You can learn to love again. I did. You can also learn something new everyday. Education is something no one can take from you.

But, for those who either don’t know that “luggage” of your partner can and will affect you after marriage, it’s news you can literally use.

The IRS will send you a letter regarding your charge off debts as “income” too. That’s right. Months after successfully resolving credit card debts, consumers may receive 1099-C “Cancellation of Debt” tax notices in the mail.

Why? The IRS considers forgiven or canceled debt as income. Creditors and debt collectors that agree to accept at least $600 less than the original balance are required by law to file 1099-C forms with the IRS and to send debtors notices as well.

The more than 4 million taxpayers a year who receive the forms must report that portion of forgiven debt as “income” on their federal income tax returns.

Why? Because you didn’t pay your debt and therefore “benefited financially” from your failure to do so.

After this important discussion with my Bride and explanation as to why I know so much about IRS Liens and Debt Forgiveness or even Zombie Debt, my Bride must have a serious discussion about what else the Groom is hiding. It’s an important discussion.

There’s a reason I hate surprises and the reason is that I’ve been surprised myself.

Leaving my home worried about my Bride, I went to take a look at a trade. This wall hanging fish has been something I’ve always wanted.

The photo uploaded to The Pawning Planners looked great and, I was interested in this item. I had planned to hang it above my fireplace.

Don’t ask me why because I don’t even fish but, nonetheless and anyhow, my Pawning Planners Client wanted to barter her ex husbands swordfish hanging in exchange for a Divorce Party.

Since I hadn’t officiated their marriage, I wasn’t uncomfortable planning the party.

It should be noted that I cannot celebrate a divorce of any couple I’ve married.

There was substantial damage to this item as it had been thrown across the room prior to the client thinking about Bartering the item. The photo uploaded had been taken BEFORE the damage occurred.

Because of this, we worked out another trade instead. It’s impossible to fix a broken taxidermist item. Fish or animal.

I saw my ex again years after our divorce. He walked over and told me he loved me but, he never forgave me for the tax lien.

I laughed and said “you underestimated me. It wasn’t easy to represent myself in a Tax Matter. I couldn’t afford to hire a Tax Attorney either. You also believed that I was disposable. Did you marry Laurie?” He was shocked and admitted that after Laurie divorced that she wasn’t interesting anymore.

Hopefully, Laurie learned to be faithful to her next husband? We can all hope.

Love is sacrifice. Love is based on trust. Remember that because it’s important. My ex might’ve loved me but, he certainly never proved that to me.

Over the past 12 years, my ex and I finally became friends again prior to his death. I had to put anger behind me because it’s debilitating.

Rings or Regrets aside, I’m waiting to hear back from my Bride on whether the show will go on or not.

Sadly, this Dana Point Bride is as crushed as I am that her Groom was moving MORE than his clothing and furniture into her home. What do I mean? He’s also bringing his past problems to merge into his future life.

I’m not even sure that this wedding won’t be cancelled. Who could blame her?

My travel arrangements are already paid so, I’m going regardless if for no other reason that to comfort her over hot tea or a stiff drink and let her know she isn’t alone.

Experience is a great teacher and I’m guessing, my Bride is having second thoughts.

By the way, since you are probably wondering, I insisted on a credit report from Matthew. I did explain why I wanted to know if he had credit issues and after hearing why, he understood my reasons.

Never knowing that a year into my marriage that my husband would go broke and get sued wasn’t something I could anticipate. Protecting him and forcing non suits on his Lawsuits?

Yes, I fought for him because he wasn’t throwing me under a bus INTENTIONALLY. My other husband did that and no one was ever going to do it again.

My current husband is forever grateful that rather than crying in my beer that we had gone broke in three years, I got up and educated myself.

I learned how to fight back for him and I did something no one else would have to protect him. I saved him from Default Judgments. I saved him from a lifetime of lawsuits.

We no longer are haunted by third party attorneys. We no longer live beyond our means. We have built back our savings and more because we’ve learned a valuable lesson. What is it? If we can’t afford to pay cash, we don’t buy it. Even ours cars are paid in cash.

Sharing is caring. If your partner isn’t sharing the good, the bad and the ugly, you need to ask more questions…I wish I had…